ESG strategies: benefiting from Improved Corporate and Investment performance

If ESG policies and strategies improve Corporate and Investment performance, how can Asset Managers benefit from these advantages?

There have been numerous attempts to extol the benefits of ESG and Sustainable policies to investors. One of the most comprehensive was the October 2021 Report co-written by NYU Stern Centre for Sustainable Business and Rockefeller Asset Management titled "Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published between 2015 – 2020” By Tensie Whelan, Ulrich Atz, Tracy Van Holt and Casey Clark, CFA.

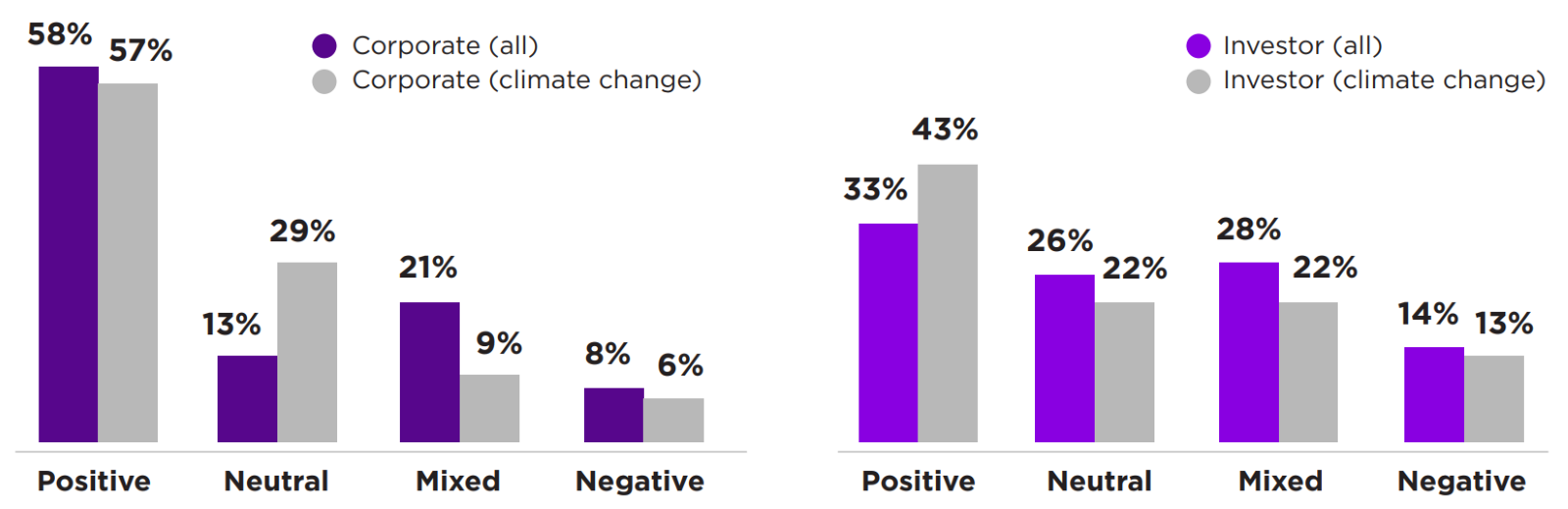

Their meta-analysis of the studies demonstrated that for all ESG strategies, in both corporations and investment funds, there was a clear outperformance advantage compared to conventional behaviour.

Source: NYU Stern Centre for Sustainable Business and Rockefeller Asset Management, October 2021

Source: NYU Stern Centre for Sustainable Business and Rockefeller Asset Management, October 2021

From the report we can see:

1. A positive relationship between ESG and financial performance for 58% of the corporate studies focused on operational metrics such as return on equity (ROE) or return on assets (ROA).

2. 59% of investment studies, typically focused on risk-adjusted attributes such as alpha or the Sharpe ratio on a portfolio of stocks, showed similar or better performance compared to conventional investment approaches.

To benefit from expected ESG outperformance, it is vital for managers to consider more than the essential Governance and Reporting requirements. To optimise results from their portfolio decision-making process, managers need to receive transparent, high-quality research with minimal delay. Using our ESG Insights platform to examine the capabilities of data and service providers, we can easily highlight the providers that focus on these essential characteristics.

One such provider is Integrum ESG. Their focus on real time alerts for significant shifts in sentiment for companies flags warning signals, the combined power of their machine-learning and analyst research reduces key data delivery from weeks to days and a glass box approach shows how all scores are sourced. These features encourage open communication between the provider and their clients, allowing better investment decisions.

About the author

Simba Mamboininga

Managing Partner